Credit Key

HOW IT WORKS

The funds you need,

right where you need them.

![]()

B2B Credit at Checkout

Fast, Easy Financing for your Business with no money down

![]()

Get a Decision in Seconds

You'll get a decision instantly. Checking your rate will not affect your credit score.

![]()

Simple, Affordable Monthly Terms

First 30 days always interest-fee. No early repayment fees.

![]()

Larger Better Lines of Credit

Lines of Business credit up to $50K - You can pay for what you use.

Credit Key is not a lease or financed loan, but a line of credit that allows

you the flexibility to purchase equipment and supplies as needed. You

can qualify for up the a $50,000 line of credit, to use and pay as needed

over a 12 month term. You will have the ability to get pre-approved for a

certain amount before you order.

ELIGIBILITY

To be eligible for Credit Key credit,

you will need to:

Be an individual applying under your own name. If your business is a Sole Proprietorship you do not need to have a Federal EIN, but will have to document some type of state registration of the business

- Owner/Signatory of business in application

- Be a U.S. citizen or resident, of minimum signing age in your state of residence

- Have a FICO/credit score of 600 or above

- Have a total annual business income of $40,000 or more

- Provide your Social Security Number

- Have a nominated bank account or debit card repayments.

- Credit Key's application process is simple and does not affect your personal credit. Credit Key does not change any setup fees. If you choose to go beyond 30 days, you can be approved as low as 1% per month. Applying for Credit Key is a "soft inquiry." This does not impact your fico/credit score.

Channellock® 426 Tongue and Groove Plier, 7/8 in Nominal, 3/4 in L C1080 High Carbon Steel Straight Jaw, 6-1/2 in OAL

Channellock® 426 Tongue and Groove Plier, 7/8 in Nominal, 3/4 in L C1080 High Carbon Steel Straight Jaw, 6-1/2 in OAL

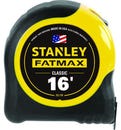

Stanley® 33-716 FatMax® Reinforced Tape Rule with BladeArmor®, 16 ft L x 1-1/4 in W Blade, Mylar® Polyester Film Blade

Stanley® 33-716 FatMax® Reinforced Tape Rule with BladeArmor®, 16 ft L x 1-1/4 in W Blade, Mylar® Polyester Film Blade

Arrow™ HT50 Professional Heavy Duty Tomahawk Hammer Tacker, Flat Crown Staple

Arrow™ HT50 Professional Heavy Duty Tomahawk Hammer Tacker, Flat Crown Staple

Klein® D2000-9ST 2000 Heavy Duty Rebar Work Cutting Plier, 9-3/8 in OAL

Klein® D2000-9ST 2000 Heavy Duty Rebar Work Cutting Plier, 9-3/8 in OAL

Estwing® E324S Framing Hammer, 16 in OAL, Smooth Surface, 24 oz Steel Head, Straight Claw, Steel Handle

Estwing® E324S Framing Hammer, 16 in OAL, Smooth Surface, 24 oz Steel Head, Straight Claw, Steel Handle

DeWALT® Power-Stud®+ Powers® 7449SD1-PWR Expansion Wedge Anchor, 3/4 in dia, 10 in OAL, 7-1/2 in L Thread, Carbon Steel, Zinc Plated

DeWALT® Power-Stud®+ Powers® 7449SD1-PWR Expansion Wedge Anchor, 3/4 in dia, 10 in OAL, 7-1/2 in L Thread, Carbon Steel, Zinc Plated

BBI® 777037 All Threaded Rod, 3/8-16, 12 ft OAL, Steel Alloy

BBI® 777037 All Threaded Rod, 3/8-16, 12 ft OAL, Steel Alloy

BBI® 754072 Medium Split Lock Washer, 1/2 in Nominal, 18-8 SS

BBI® 754072 Medium Split Lock Washer, 1/2 in Nominal, 18-8 SS

Primesource® 8CTDSKR Sinker Nail, 17/64 in, 2-3/8 in L, 9 ga, Vinyl Coated, Smooth Shank

Primesource® 8CTDSKR Sinker Nail, 17/64 in, 2-3/8 in L, 9 ga, Vinyl Coated, Smooth Shank

Campbell® T3899724 Hitch Pin, 1/2 in dia, 4-1/4 in L Usable, Forged Steel, Zinc Plated with Yellow Chromate, 5 Grade

Campbell® T3899724 Hitch Pin, 1/2 in dia, 4-1/4 in L Usable, Forged Steel, Zinc Plated with Yellow Chromate, 5 Grade